Money Services for Vulnerable Adults

Money Carer is a long established (2009), award-winning national social enterprise that provides corporate appointee and money management services for vulnerable adults. We are very proud of our ‘open-door’ policy, which means that we support people from all walks of life. Our clients range from older people with memory problems, to individuals with learning difficulties, to folk who struggle with addictions and mental health challenges.

Our unique banking and payments platform is linked to our smartphone app and is used by hundreds of law firms, local authorities, care providers, family members and, of course, our fantastic, clients.

Our infrastructure is solid and robust. Our scale capabilities actively support many local authorities and care providers struggling with the much-documented social care resource limitations. We are debt free organisation due to our robust management disciplines and business acumen.

Our experience and commitment

Our range of appointeeship services support vulnerable people with differing money management needs from all walks of life and we promote client autonomy and a best interest approach in everything we do.

We are the organisation that developed and brought to market the concept of carer cards, and we continue to invest in developing our proprietary banking and payments software and systems that are used by hundreds of law firms, local authorities and care providers.

Our commitment to this investment enables us to provide innovative solutions to everyday money management problems experienced by our vulnerable clients and their carers.

We harness our own resources and expertise to partner with local authorities and care providers that may be struggling or unable to provide money management services to vulnerable client groups.

We are a national partner to the Department of Work & Pensions (DWP) and we work with in excess of 100 local authorities, circa 200 law firms and hundreds of care providers who use our services.

Listen to The Money Carer Podcast

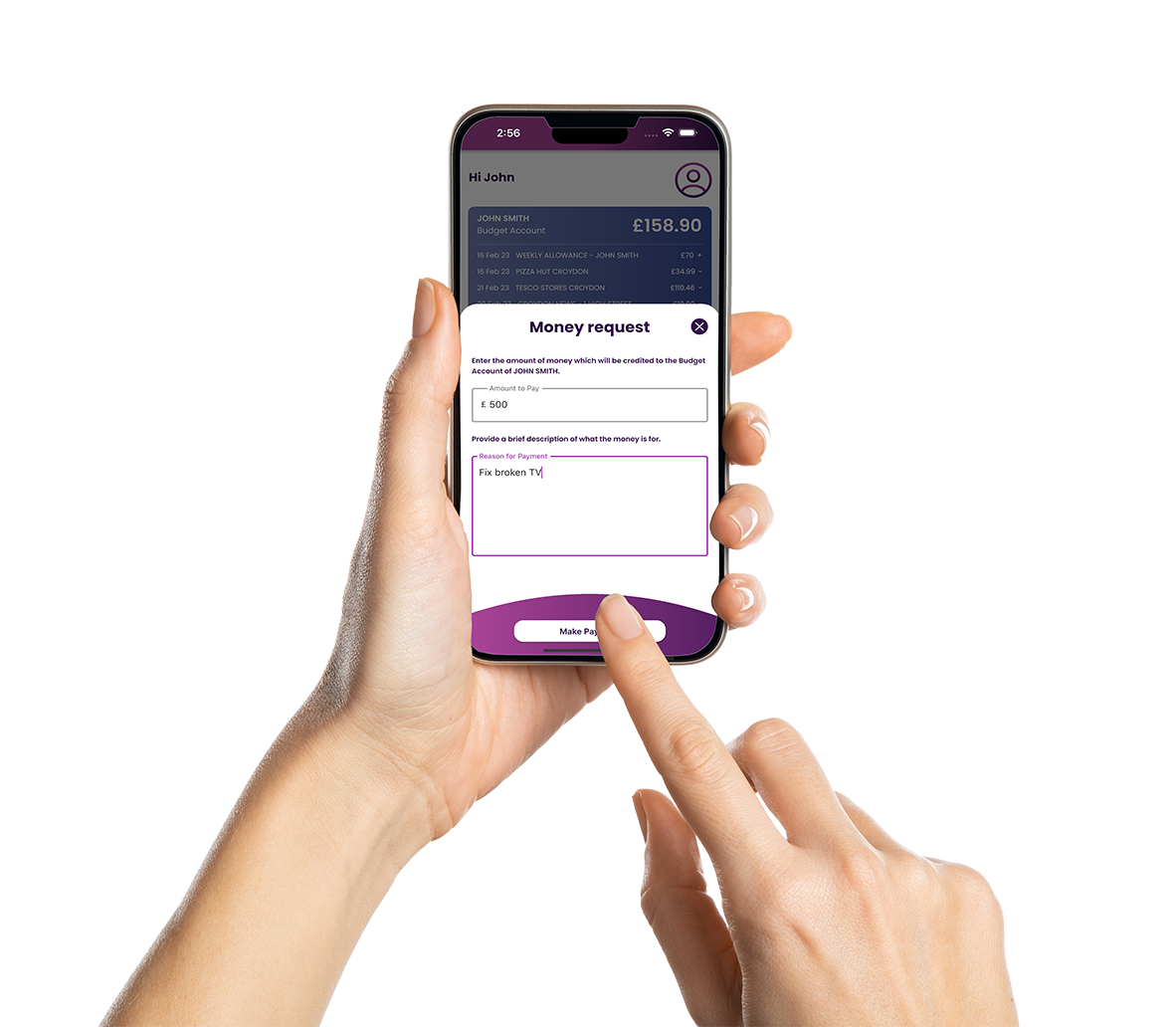

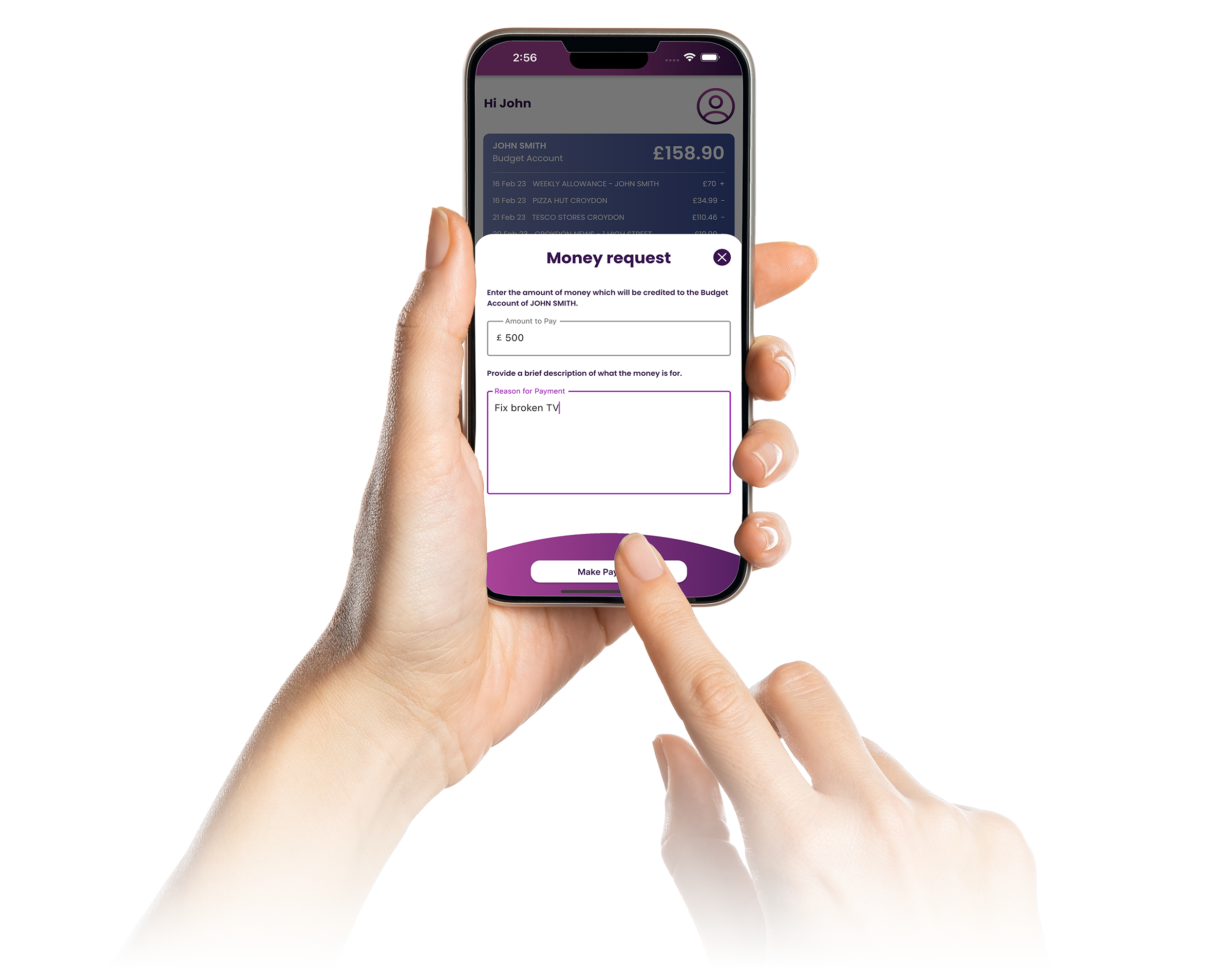

The Money Carer App

Our smartphone app has been designed with our clients and their busy carers in mind. The Money Carer app is available to download in the App Store and Google Play.

- See balances and transactions for all your clients

- Make money requests instantly

- View welfare benefit letters and other documents

- Send secure messages to Money Carer

- Securely send receipts, bills and other documents

- Download statements for auditing and reconciliation

- View clients spending plans and budgets

- Generate ‘savings envelopes’ for larger purchases

How we help

Money Carer Podcast

Keep up to date with all things money management, appointeeship and deputyship. Listen to the views of different guest experts and send in your questions or podcast topic suggestions.

Subscribe on YouTube or Spotify to receive the latest updates and appointee, deputy and money management news.

Our Banking Platform

Uniquely, we have our own banking platform with Cashplus Bank. This enables us to open bank accounts easily for our own clients and also, the clients of law firms, local authorities and family members representing vulnerable loved ones. So long as the correct legal authority is in place, we can open a bank account on our platform. Cashplus Bank has supported our clients and the vulnerable clients of our partners for over 10 years solidly.

Money Management

As the largest provider of independent appointeeships, we support and protect thousands of vulnerable people with their everyday money management needs by delivering an independent and innovative service.

Bulk Appointeeship Transfers

We project manage the bulk transfer of appointeeships from care providers and local authorities so that we can represent individuals independently and more cost-effectively. Care providers and councils then benefit from our secure information-sharing platform.